do you pay sales tax on a leased car in california

75 California Sales Tax on Car Purchases. To calculate the tax rate for a qualifying purchase subtract 500 percent from the tax rate that would normally apply at the location where the aircraft is principally hangared.

Oregon Vehicle Sales Tax Fees Find The Best Car Price

On June 29 2020 California passed Assembly Bill AB 85 Stats.

. Does the sale taxes are calculated based on the full price of the car or the initial lease amount and divided on the number of payments. With some exceptions the lessor party who is loaning out the property must collect use tax from the lessee party obtaining the property at the time of the rental installment payment. The car buyer is responsible for paying VAT during a private car sale.

Keep in mind sales tax is different from all the state fees you may have to pay to register title or inspect a vehicle you lease or buy. 20000 X 0725 1450. 8 and AB 82 Stats.

Remember automobile sales tax is collected by the DMV on behalf the tax authorities in California. Apparently California just raised sales taxes and that increase is why the monthly lease has gone up by about 115 a month for us. Its called a third-party buyout.

Since the lease buyout is a purchase you must pay your states sales tax rate on the car. Local governments such as districts and cities can collect additional taxes on the sale of vehicles up to 25 in addition to the state tax. If you buy a vehicle for 12000 and trade in your old vehicle for 6000 you will still have to pay taxes on the 12000 for which the car was originally sold.

The 10 day window is the easiest way to execute the transaction with the DMV. A lease buyout which usually occurs at the end of your lease period is when you opt to keep your leased car rather than return it to the dealer. The buyer must pay sales tax to the California Department of Motor Vehicles upon registration of the vehicle.

When you buy out your lease youll pay the residual value of the car its value at the end. Like with any purchase the rules on when and. As of September 2011 Oregon Alaska New Hampshire Montana and Delaware do not assess a sales tax on consumers but if you live in one of these states you may be subject to.

While most people dont have to pay taxes on a rented property thats not the case with leased vehicles. There is also a 50 dollar emissions testing fee which is applicable to. In most cases youll owe a percentage of the vehicles value as.

For example even though Delaware has no state sales tax it currently charges a document fee of 425 of the purchase price of a vehicle or the NADA book value whichever is more. 1450 is how much you would need to pay in sales tax for the vehicle regardless of if it was used purchased with. Sales tax is a part of buying and leasing cars in states that charge it.

The minimum is 725. The dealership is telling me that I will need to pay sales tax on the original price. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725.

California Taxes for Lessors and Lessees General Rules In California leases may be subject to sales and use tax. Beginning January 1 2021 certain used vehicle dealers are required to pay the applicable sales tax on their retail sales of vehicles directly to the Department of Motor Vehicles. Bank of America which held the lease facilitated the transaction without requiring us to pay sales tax.

A lease usually lasts from two to five years. When you purchase a car you pay sales tax on the total price of the vehicle. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments.

Dealers are exempt from paying taxes till they resell. When you lease you are only paying the vehicles depreciation during the lease term plus rent charges taxes and fees. CA Rev Tax Code 6203 b 2017.

In CA you have 10 days to transfer the title to the new owner with all fees paid in order to not pay taxes on lease buyout. Answer 1 of 5. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments.

Of this 125 percent goes to the applicable county government. According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. In a lease you do not own the vehicle.

If the transaction takes longer than ten days the seller documents the odometer reading at the beginning of the process the odometer at the actual sale with an. The amount of taxes youll owe on your leased car will depend on the state where you live. You will have to pay taxes on your leased car each year that you have it.

When you sell the car you file for a form with DMV which doesnt hold you liable. Same way its calculated in any other state- monthly payment multiplied by your state sales tax rate s the sales tax on the lease payment- On a lease you pay sales tax monthly not up front - so just take your base payment lets say 350 a month-. For vehicles that are being rented or leased see see taxation of leases and rentals.

You pay tax monthly based off purchase price if you move your. Making the distinction between a true lease or sale at the outset is crucial because for sales the tax must be. My lease is almost up and I would like to purchase the car.

Gluck December 26 2018 1142pm 8. Multiply the vehicle price before trade-in or incentives by the sales tax fee. Payments for a lease are usually lower than payments for a purchase.

The partial exemption applies only to the state general and fiscal recovery funds portion of the sales and use tax currently 500 percent. What is California tax on car lease. The California State Board of Equalization Board has promulgated Regulation 1660 which explains the law as it applies to leased property in general and transactions that may look like leases but are actually outright sales.

Heres an explanation for. You rent it and can choose to buy it at the end of the lease.

Man Unlock Car Door By Key Stock Image Image Of Close 4027343 Unlock Car Door New Cars Car Lease

Bill Of Sale For Car Pdf Templates Jotform

Car Leasing Costs Taxes And Fees U S News

The Boulder Group Arranges Sale Of Net Leased 7 Eleven Property Denver News Bouldering Property

What Happens To New Cars That Don T Sell

Can I Buy A Car With A Credit Card Nerdwallet

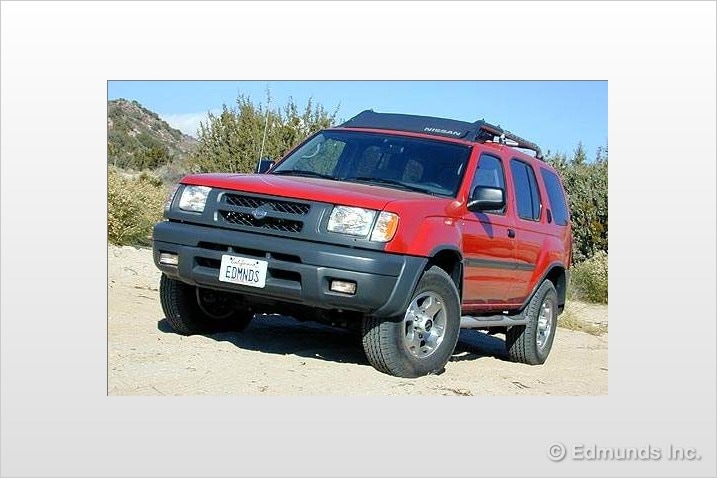

Can Buying A Demo Car Save You Money On Edmunds Com

Tesla Refund And Return Problems Detailed

Which Cities And States Pay The Most And Least For Cars Kfor Com Oklahoma City

Can Buying A Demo Car Save You Money On Edmunds Com

/GettyImages-1149840562-13a9b89e0d254e7ab2df16d1494f6c71.jpg)

How To Get The Best Price On A New Car

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Can Buying A Demo Car Save You Money On Edmunds Com

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips