extended child tax credit 2021

Most parents who received monthly payments in 2021 will have more child tax credit money coming this year. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

However the 2021 American Rescue Plan expanded this credit in.

. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Starting July 15 families will start receiving monthly payments as high as 300 per child as part of the new expanded child tax credit. Dont Miss an Extra 1800 per Kid.

Along with a 1400 stimulus check and extended unemployment benefits the 19 trillion COVID relief package signed into law on Thursday expands the Child Tax Credit. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing. Poor mothers get shut out of the Child Tax Credit our research finds.

Home Childrens Monitor Research The Impacts of the 2021 Expanded Child Tax Credit. The 500 nonrefundable Credit for Other Dependents amount has not changed. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US.

First the maximum percentage for 2021 is bumped up from 35 to 50. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in. 22 hours agoOne reversal in particular that stands out is the expanded child tax credit or CTC which Congress passed as part of 2021s American Rescue Plan Act and failed to.

Advance Child Tax Credit Payments in 2021. The legislation made the existing 2000 credit per child more generous. 2 days agoAs for expanded child tax credit legislation sponsored by Sen.

It also made the. CHILD TAX CREDIT f You may receive up to 3600 for each child age 5 and. More paid expenses are subject to the credit too.

Brookings published the second wave of its comprehensive multi-issue study of the effects of the CTC finding that families used the CTC to cover routine expenses without reducing their employment. IRS Child Tax Credit Money. Register here to read the Journals tax ebook.

3600 for children ages 5 and under at the end of 2021. Under current law she receives a Child Tax Credit of 1875. Families had better nutrition and were less likely to.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act.

How to get the second half of the 2021 Child Tax Credit As lawmakers in Washington grapple over extending those payments officials are urging parents. Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable. 2 days agoA single mother with a toddler and a child in elementary school works part time around her kids schedule earning 15000 a year as a child care worker.

The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent children. Here is some important information to understand about this years Child Tax Credit. That meant if a household claiming the credit owed the IRS no money it couldnt collect its.

What Is the Expanded Child Tax Credit. 2 days agoThe child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. Instead of up to 3000 in expenses for one child and 6000 for two or more.

Now its been boosted to 3600 for children younger than 6. This tax credit is changed. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return.

3000 for children ages 6 through 17 at the end of 2021. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act. Theres good news for American families.

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. It provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and phase-in. The credit originally created in 1997 used to be up to 2000 per child annually.

If the current credit were fully refundable she would receive a 4000 credit 2000 per child. This means that for 2021 the total maximum child tax credit is 3600 per child under six and 3000 per child from ages six to. To get the full credit 2000 per child before 2021 the tax filer must earn at.

To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of. Mitt Romney R-Utah it would not only need to attract bipartisan support something thats highly unlikely. Originally it offered taxpayers a tax credit of up to 2000 for each qualifying dependent.

The Child Tax Credit provides money to support American families. In the year 2021 following the passage of the American Rescue Plan Act of. The payments expired at the end of last year.

Making the credit fully refundable.

Expiration Of Child Tax Credits Hits Home Pbs Newshour

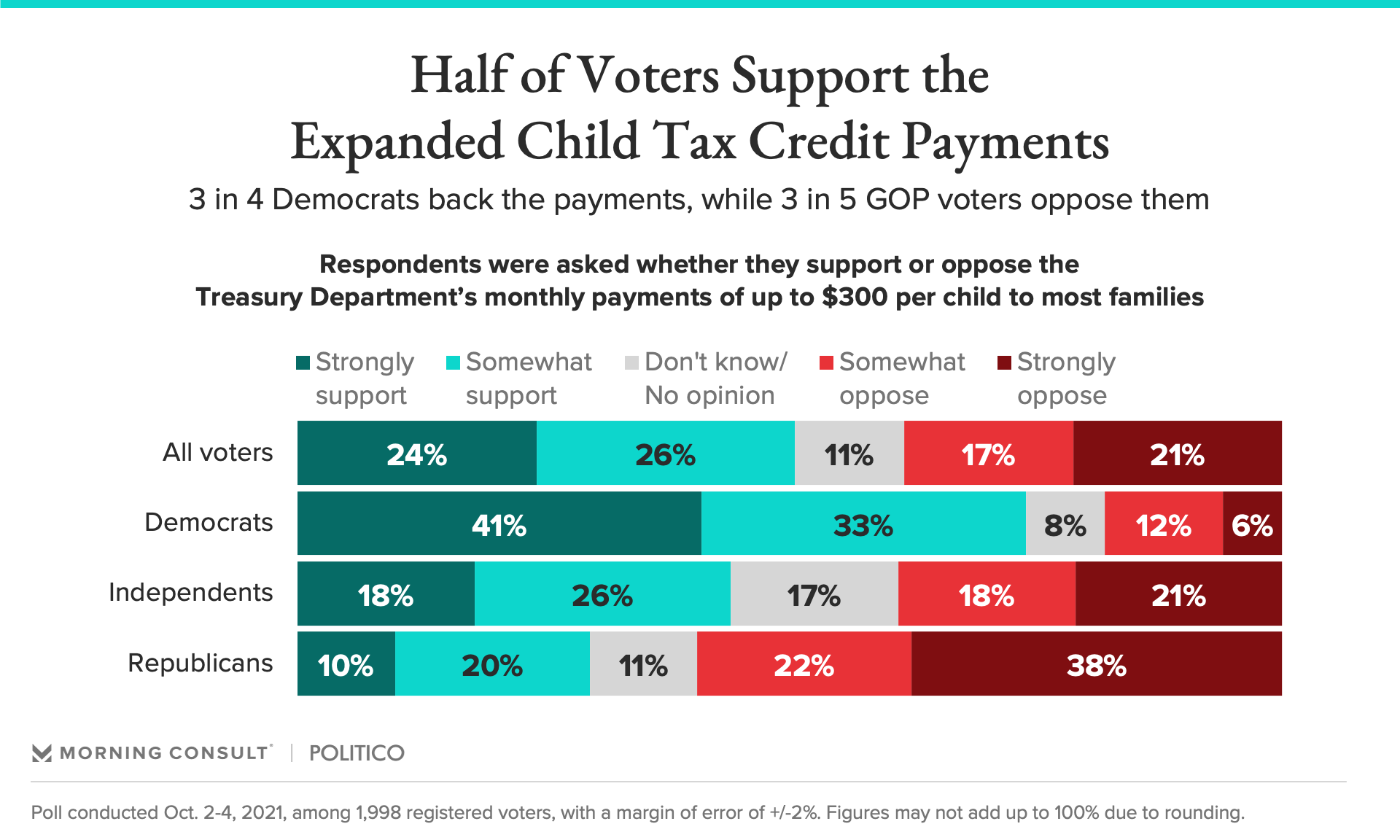

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Child Tax Credit 2021 8 Things You Need To Know District Capital

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Payments From The Expanded Child Tax Credit Are Being Sent Out Npr

Child Tax Credit Schedule 8812 H R Block

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

What Families Need To Know About The Ctc In 2022 Clasp

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Claim Advance Child Tax Credit On 2021 Return Filing Wusa9 Com

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Child Tax Credit 2021 8 Things You Need To Know District Capital